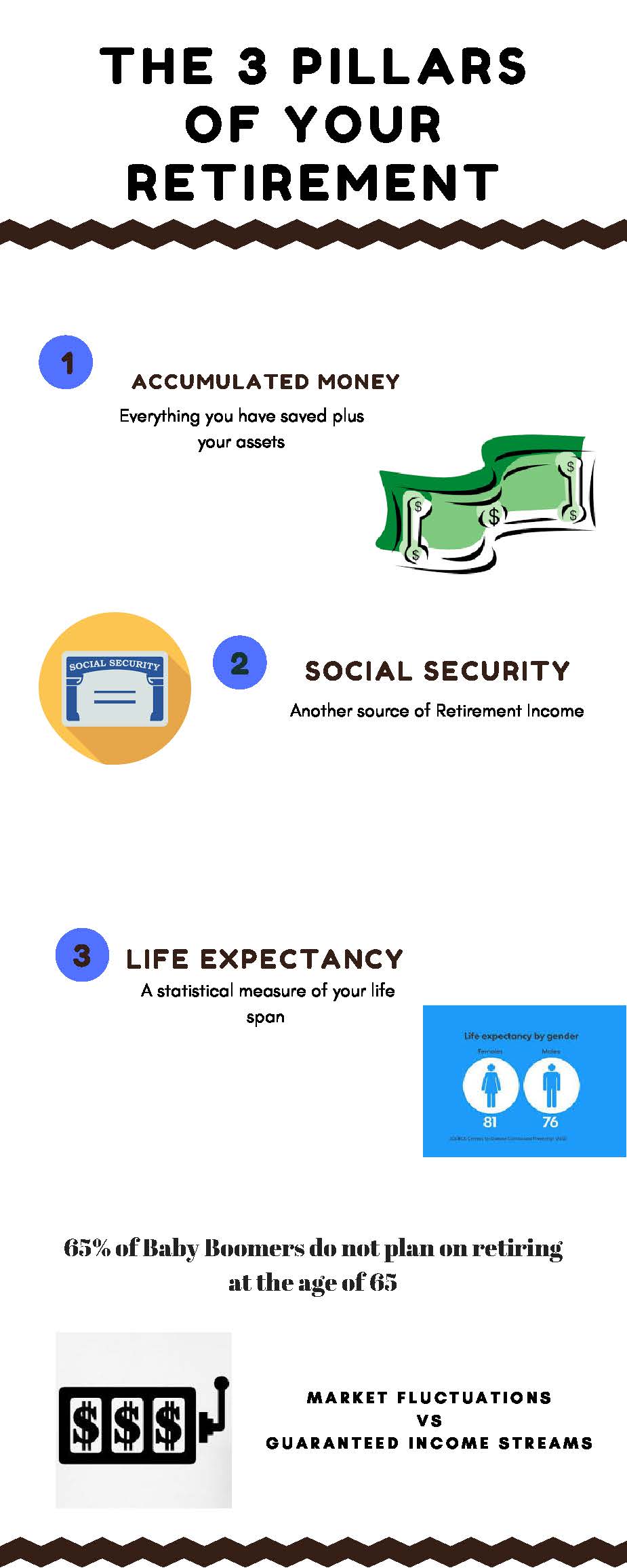

An increasing fear for a lot of people is not having enough money in when they retire. Sixty-five percent of baby boomers plan on working past age 65 because they do not have enough retirement savings. Most financial advisors have programs that can generate fancy reports with positive returns and pretty graphs but knowing the downside potential and guarantees inside your retirement plan is extremely important. It is prudent to analyze the assumed interest rates and fees inside your retirement plan to calculate the correct distributions from your nest egg so you do not run out of money. By using various interest rates over multiple periods of time along with various market fluctuations the results can widely vary. Be realistic with the money you have accumulated, social security payments, and your life expectancy to determine reasonable withdrawals from your nest egg. Your financial advisor’s assessment should factor in the possibility of an annuity for a piece of your retirement plan to guarantee an income stream that could compliment your social security income. This will guide you accordingly depending on your target.

An increasing fear for a lot of people is not having enough money in when they retire. Sixty-five percent of baby boomers plan on working past age 65 because they do not have enough retirement savings. Most financial advisors have programs that can generate fancy reports with positive returns and pretty graphs but knowing the downside potential and guarantees inside your retirement plan is extremely important. It is prudent to analyze the assumed interest rates and fees inside your retirement plan to calculate the correct distributions from your nest egg so you do not run out of money. By using various interest rates over multiple periods of time along with various market fluctuations the results can widely vary. Be realistic with the money you have accumulated, social security payments, and your life expectancy to determine reasonable withdrawals from your nest egg. Your financial advisor’s assessment should factor in the possibility of an annuity for a piece of your retirement plan to guarantee an income stream that could compliment your social security income. This will guide you accordingly depending on your target.

[youtube id=”EpIqd_Lp7gE”]

THE ISSUE WITH ANNUITIES

Some advisors are against annuities because of certain fees associated with mutual funds and riders which can be more expensive than alternative similar investments such as ETF’s and view ALL annuities as a bad option. Unfortunately, these advisors are missing the boat when it comes to fixed annuities and the impact they can have on someone’s holistic financial plan. If you choose a lifetime annuitization option, annuities can provide a guaranteed income stream which can give people piece of mind since they will receive a guaranteed payment from the insurance company each month or year. This payment combined with one’s social security can create a security blanket for people as they near retirement age. Shifting retirement savings to annuities can minimize the stress of stock market fluctuations during their golden years.

Other advisors know diverting retirement assets to annuities translates to a smaller nest egg for them to manage which generally translates to less commissions and fees. Fixed annuities typically pay an upfront commission to the agent who sells it, which over the long run is a lot less money out of their pocket. Hopefully you work with an honest advisor who acts in a fiduciary capacity on your behalf and stays current with product knowledge in the retirement planning space.

Strategies that Guarantee Retirement Income

There are basically two types of annuities, immediate annuities and deferred annuities. Both types can annuitize and generate a guaranteed retirement income stream, deferred annuities can defer accumulated monies for a longer period such as 7 to 10 years before turning on an income stream. Immediate annuities generally turn on the guaranteed income stream after 30 days, the longest a person can wait is one year from the purchase of an immediate annuity to turn on the income. Working with an advisor who is familiar with annuities could bring more guarantees in your overall retirement income planning. If you are paying a financial advisor for such services, it is not unreasonable to have them design a retirement plan incorporating an annuity into the equation.

Knowing your social security income payout is critical in determining the amount of money one should put into annuities. Your financial advisor should provide you with a projected benefit amount and incorporate into the overall retirement plan. As you grow old, you need financial security as well as a peace of mind during retirement, the idea is to make informed decisions.

Your Health

Another issue to consider is your health. Does your retirement plan consider the expenses associated with a spouse’s illness? What is your life expectancy? Is there a medical condition that could significantly shorten your life or your spouse’s life? Your advisor should consider your health, as well as your family history to determine if an annuity is an appropriate solution. There is no health underwriting for annuities and are typically not suitable for people in poor health. Immediate annuities with lifetime income streams are most beneficial for people who outlive their life expectancy. The insurance company will continue to make payments until the insured passes away, ultimately increasing the total rate of return.

If you are not currently working with a financial advisor who incorporates the possibility of annuities into your retirement plan, we can put you in touch with an independent insurance agent who can give you more information.